As the interest rates are falling and

FD rates are moving southwards, It is becoming increasingly challenging to find

out other option which can be safer and also provide better returns from Bank

FDs. Investors especially retired persons who wants safety of their investments

and also regular income finds market volatility too hot to handle hybrid funds

with Systematic Withdrawal Plans (SWPs) set up for regular cash flow could be

better option which can still help investors fight inflation. Further a smart

option could be setting up SWPs on accrual funds, especially with funds that

have waived exit loads for SWPs.

Generally risk

averse investors continue to choose bank deposits as their preferred investment

option. Conservative people normally go for FDs after retirement, as the comfort

of a regular, predictable cash flow is very necessary at that stage of their

life. However in current environment where the interest rates are low and going

further downwards while inflation is sticky, , in the quest for safety of

capital, people land up unknowingly losing the fight against inflation,

consequently see the purchasing power of their fixed income eroding over time.

The challenge in

SWPs from hybrid funds

We all understand that

an element of equity in the retirement corpus can help retired people in the

long term to win the battle against inflation quite comfortably. However we should

not forget that the long term is also actually a series of short terms. Generally we wish that the equity component of

our investment would first appreciate so that we get a buffer and also insulate

us from significant market volatility so as to have a corpus which can fight

the inflation. However the equity market does not behave in such a simple and

systematic way and if the market moves up people may take out that money and

again put in FDs so as to get the required regular monthly Cashflow. The returns and appreciation from Balance and

other Hybrid funds may not be stable and hence quite challenging to continue

SWPs (Systematic withdrawal plans) from these funds, especially when the corpus

has gone into negative territory. For any investor the first priority is always

to resolve the anxiety of today rather than worry about what may happen 10

years down the line in terms of reduced purchasing power.

In this type of

situation what could the best solution in these circumstances? In this type of situation Debt Mutual Funds

could be an ideal option which are not complicated but have the potential to

give better returns than FDs and also have some, though not fully but have scope

to face the war against inflation. In Debt mutual funds an investor may not

create wealth, but at least may not erode his capital due to a combination of

inflation and taxes.

What are Debt

Mutual Funds:

- Debt mutual funds invest in Government Securities, Bonds and Corporate Debentures etc which promise regular fixed income on monthly quarterly annually or on maturity.

- Unlike Fixed Deposits interest, Dividend form Debt mutual funds are completely tax free. FD interest payments on the other hand attract tax Deducted on Source (TDS).

- Any Profit an investor make from Debt Funds after three years are adjusted for inflation and get the tax benefits of Long Term Capital Gain Tax.

- Debt funds are often classified as low or medium risk investments. This means the possibility of losses is low means safety to the capital.

- However all said done, debt funds do not promise a regular income. When interest rate rises prices of fixed income securities i.e. bonds falls. This could even lead to losses, leading to fall in overall returns.

The ideal option

for an investor who wants regular cash flows could be an SWP from a low

maturity debt fund. The primary objective of this plan is:

- Little volatility in returns and marked to market

valuations

- Low taxation, Since tax is only applicable on the

gain on the units redeemed every month not on the entire withdrawal amount

- Growth of principal over time

- Low reinvestment risk as fund managers manage the

average maturity of the fund and don’t take high duration risk

- No exit load on SWP amount, hence no charges for

monthly SWP

- Complete or partial liquidity as funds withdrawal is

possible within one day notice.

- Flexibility to increase or decrease the SWP amount

based on a person’s requirement and funds performance

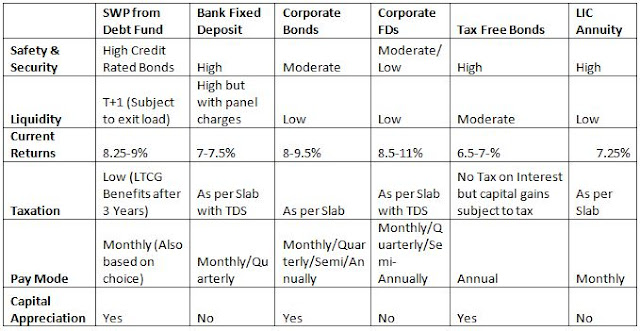

- The other investment options with similar objectives are: Corporate Bonds, Corporate Fixed Deposits, Tax Free Bonds and LIC annuity plans.

Apart from Retired

persons there could be other people/organisations who may also have similar requirements

and find the debt mutual funds a better option those could be:

- Charitable Trusts and hospitals, who have large

trust corpus and need regular cash flow for meeting their obligations

- Gymkhanas and Clubs who have a large membership

corpus and require monthly income for meeting regular expenses for events,

maintenance and salaries

- Cooperative Housing Societies who have a deposit

corpus and need monthly income for meeting maintenance expenses

- Real Estate investors who look for rental income.

Here no hassle of finding tenants, following up for payments and paying

various taxes on the rent

- Corporates who have cash holdings and require a

regular income for various statutory expenses

- Individuals and families who have received an

inheritance or sold a property and are looking for a steady income

- Life insurance claimants, who have lost the

breadwinner. The insurance claim can be used to earn a steady monthly

income

No comments:

Post a Comment